Lowercap launches Poland’s first hybrid public–private VC fund

A new VC model blends EU, regional, and private capital to fuel SME growth and anchor startups in Lower Silesia

Lower Silesia has unveiled Lowercap, a pioneering investment vehicle designed to reshape how early-stage companies in Poland access capital. Structured as the country’s first VC fund to combine regional government money, EU funds, and private investor capital into a single deal-by-deal framework, Lowercap aims to deploy up to €23M into micro, small, and medium-sized enterprises that commit to growing within the region. The initiative marks a strategic shift in how local governments stimulate innovation, positioning Lower Silesia as a contender for the most comprehensive regional entrepreneurial ecosystem in Central Europe.

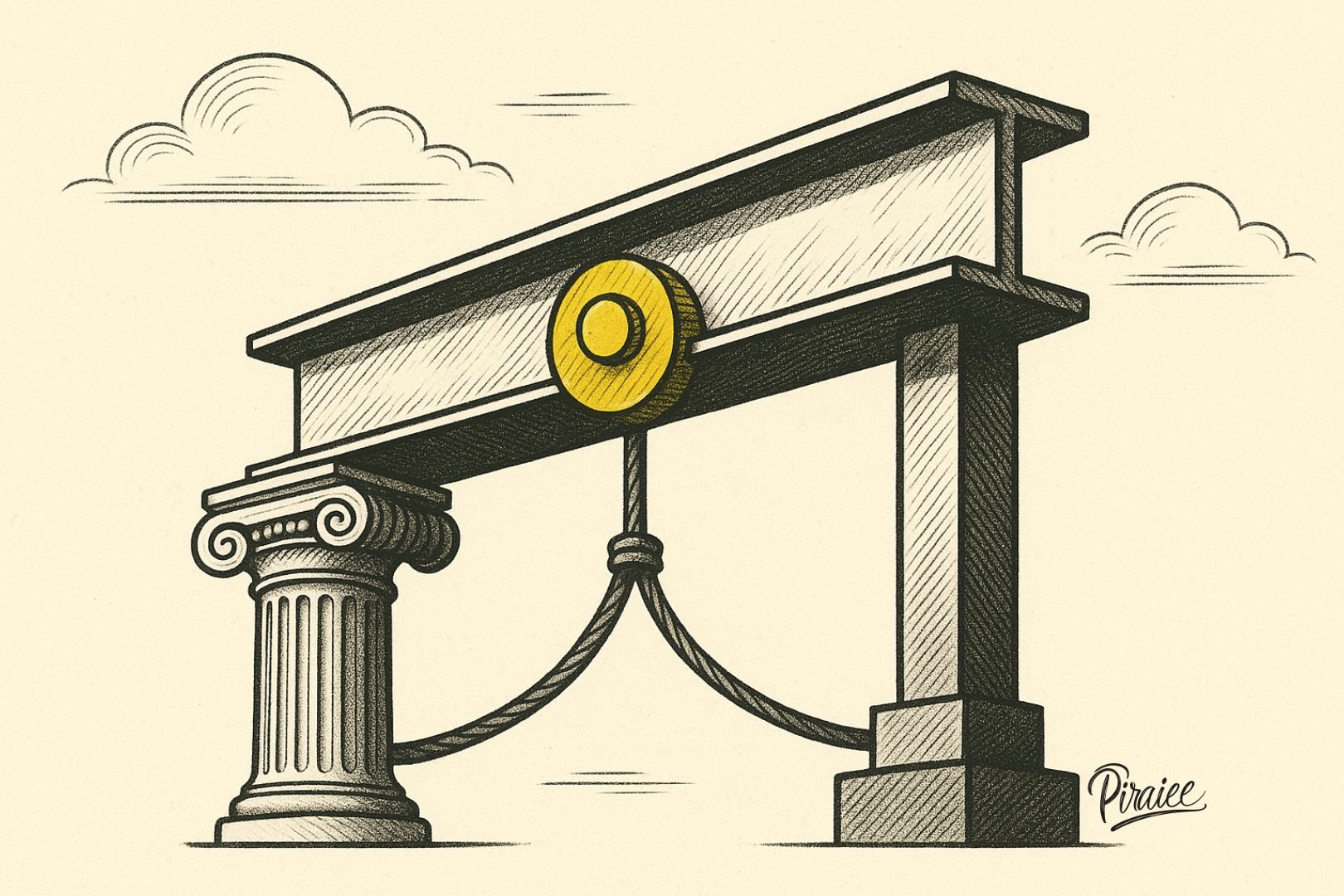

At the heart of Lowercap’s model is a financing structure designed to limit public-sector risk while expanding the capital available to founders. Public contributions act as an anchor to attract co-investment from private backers, including a growing network of about 20 angel investors. With exits recycling capital back into the ecosystem, the region expects long-term compounding effects: more startups funded, fewer companies relocating to Warsaw or abroad, and a greater concentration of advanced technologies emerging locally.

Subscribe to Startup Digest to stay ahead with the latest news, investments, and must-attend events.

Lowercap fits into a broader strategy the region has been building for several years. Alongside Going Global (export acceleration), the Dolnośląski Fundusz Rozwoju (loans and guarantees), and innovation hubs such as TriQbe and DPIN, the fund completes what officials describe as a “full-stack” support system for high-potential companies. This ecosystem has already produced notable alumni through earlier investment instruments, including spacetech scaleup Scanway, edtech company LiveKid, KFB Acoustics, and sustainable products brand YourKaya. Their growth demonstrated both the potential of Lower Silesian startups and the need for a larger, more flexible capital pool.

The new fund specifically targets firms with validated products and scalable models, whether in IT, greentech, industrial innovation, or consumer solutions. While headquartered in Lower Silesia, Lowercap welcomes entrepreneurs from across Poland willing to relocate their operations. Financing can support international expansion, product development, workforce growth, or technology acquisition, and is complemented by access to sector experts and strategic advisors.

Regional officials view the initiative not only as an investment tool but also as a retention mechanism. According to Deputy Marshal Michał Rado, keeping high-growth firms rooted in Lower Silesia is critical for long-term competitiveness: the region intends to build an alternative gravity center for innovation outside Mazovia. Lowercap therefore serves as both a financial catalyst and a strategic instrument—one capable of drawing talent, capital, and research into a single concentrated environment.

Lowercap is managed by Lowercap DFR ASI, led by CEO Krzysztof Górka, who emphasizes that the fund’s hybrid structure mirrors the most mature European regional models. The goal is twofold: provide a sustainable engine for local economic development and show that coordinated public-private cooperation can produce market-level investment decisions while fulfilling regional impact objectives. With a potential €23M available over the coming years, the fund is positioned to become one of Poland’s most significant regional VC experiments.

If successful, Lowercap could mark a turning point in how Polish regions compete for founders, capital, and innovation—potentially establishing Lower Silesia as the country’s second-strongest startup hub after Mazovia. Its arrival signals an ambition not only to fund companies, but to anchor an entire generation of growth-oriented SMEs in one of the most dynamic regions of Central Europe.