Movens Capital Launches €60M Fund to Fuel CEE Tech Startups from Pre-Seed to Series A+

Movens Capital Raises €60 Million for Multi-Stage Fund Backed by EBRD and PFR Ventures to Invest in Central and Eastern European Startups.

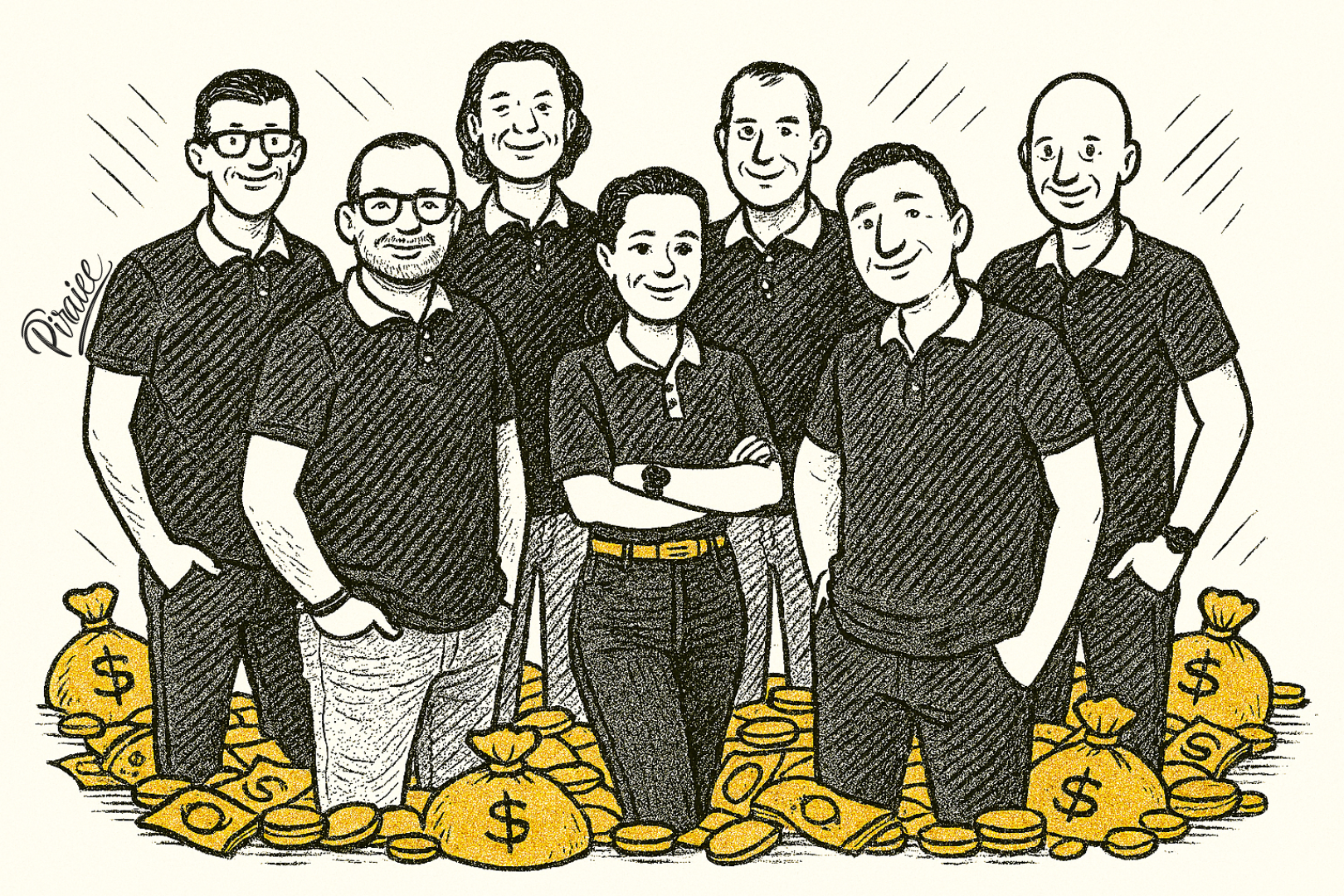

Polish venture capital firm Movens Capital has launched its second fund, targeting €60 million to invest in tech founders from Central and Eastern Europe (CEE) at all early growth stages—from pre-seed through Series A+. The fund has already reached a €40 million close in Q2 2025, with backing from major institutional players including the European Bank for Reconstruction and Development (EBRD) and PFR Ventures, alongside over 80 individual investors, 40+ of whom are prominent tech founders and operators from the region.

Subscribe to Startup Digest to stay ahead with the latest news, investments, and must-attend events.

Fund 2 marks a bold move to bridge the persistent funding gap in the CEE startup ecosystem, particularly for Series A and growth-stage companies. Despite an increase in the number of startups and ecosystem value, VC funding in CEE remains drastically below Western Europe, with 2024 investment volume down 23% and the number of deals down over 70% from 2022 (Dealroom, 2025). Per capita venture investment still hovers at just €13 in CEE, compared to €85 in Western Europe.

“We’ve never lacked talent in CEE—what’s missing is capital and operational firepower to turn that talent into global champions,” said Artur Banach, Managing Partner at Movens Capital. “With this new fund, Movens will act as a launchpad for ambitious founders, backing 30+ startups and scale-ups with checks ranging from €250,000 to €3 million, and up to €20 million in follow-ons with co-investors.”

Movens Fund 2 will target enterprise software, healthcare, fintech, climate tech, e-commerce infrastructure, education, and AI-native infrastructure, with a special emphasis on companies using AI and machine learning in novel ways. The fund plans to lead the majority of its investments, which include 10+ Series A+ deals and founders from the CEE diaspora building globally.

This builds on the success of Movens Fund 1, whose portfolio includes well-known names like:

Alokai (formerly Vue Storefront) – a leader in composable commerce infrastructure.

Packhelp – exited packaging-tech startup.

SKY ENGINE AI – providing advanced simulation tools for computer vision.

Talkie.ai – a Polish conversational AI startup for customer support.

Doctor.one, Certifier, Fenige (exited), and others.

Fund 1 portfolio companies have raised more than €110 million in follow-on capital, drawn interest from top-tier global VCs, and successfully scaled internationally. Movens is also known for its founder-centric approach and ranks highly for founder satisfaction and operational support in the CEE region.

Anne Fossemalle, Director, Equity Funds at EBRD, commented: “We are delighted to support Movens Fund 2 as part of our commitment to growing the VC ecosystem in CEE. Their operational depth and network-driven approach offer exactly the kind of leverage early-stage founders need to thrive.” Bartłomiej Samsonowicz, Investment Director at PFR Ventures, added: “Movens Capital has proven itself in Fund 1 with strong investor relations and a track record of helping companies scale. We’re confident Fund 2 will further expand access to smart capital in the region.”

Movens is already deploying Fund 2, with the first wave of investments expected this summer. The team brings decades of entrepreneurial and machine learning expertise, offering support on product strategy, pricing models, team building, and investor readiness.

About Movens Capital

Movens Capital is a Warsaw-based multi-stage VC firm backing globally ambitious tech startups from CEE. With investments from pre-seed to Series A+, Movens provides capital and deep operational support. Learn more at movenscapital.com

About EBRD

The European Bank for Reconstruction and Development promotes private sector development in 36 countries across Europe, Asia, and Africa. It is owned by 75 countries, the EU, and the EIB.

About PFR Ventures

PFR Ventures is a Polish fund-of-funds manager investing in venture and private equity funds, co-financed by the European Union and Polish government. Its portfolio includes 90+ funds with over 900 startup investments.