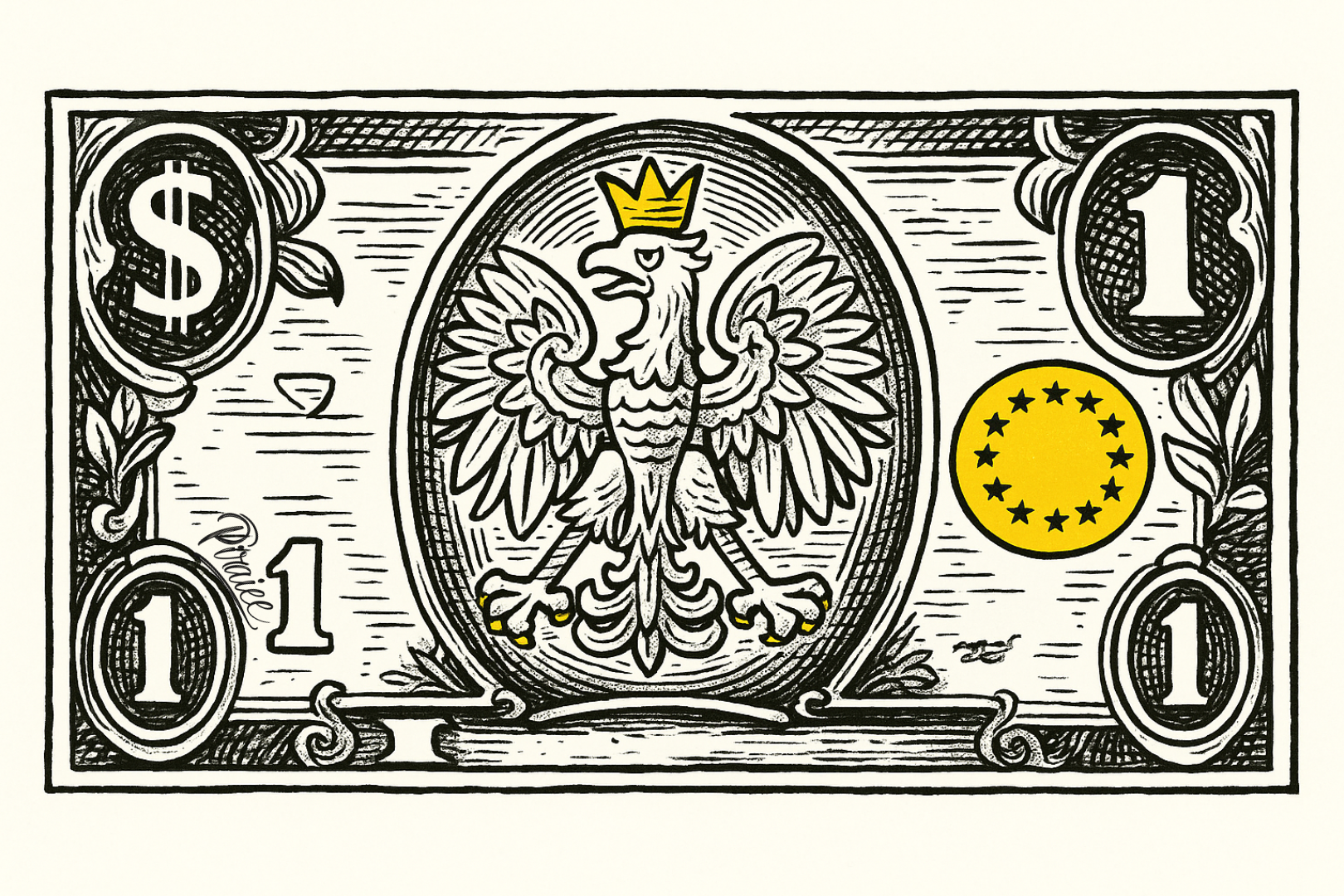

Poland’s quiet ascent: from periphery to pacesetter of G20

WARSAW — June 28, 2025 For much of the 20th century, Poland was described with hyphens: post-communist, post-crisis, post-reform. That narrative no longer fits. As Europe grapples with stagnation and geopolitical anxiety, Poland is stepping into a role that few foresaw and fewer still can ignore: a frontline economic and strategic power, rising from the EU’s eastern flank into the global core.

Subscribe to Startup Digest to stay ahead with the latest news, investments, and must-attend events.

In May, The Economist placed Poland on its cover under the headline: “How Poland can keep its place at the heart of Europe.” The article pulled no punches—labeling Poland “Europe’s most overlooked military and economic power,” while highlighting a military budget that now exceeds 4% of GDP, a surging manufacturing sector, and a leadership increasingly fluent in the politics of 21st-century Europe. If Germany is the EU’s spine, Poland is becoming its muscle. Quietly but decisively, Poland is reshaping the balance of power inside the EU—and possibly the G20.

The Numbers Don’t Whisper. They Roar.

According to the International Monetary Fund’s April 2025 World Economic Outlook, Poland’s economy will grow by 3.2% this year—outpacing every major Western European economy. By contrast, Germany is projected to flatline (0.0%), France to crawl at 0.6%, and the Euro Area as a whole to barely reach 0.8%.

Poland’s nominal GDP is expected to reach $980 billion, placing it 20th globally. In purchasing power parity terms, it sits 19th, with a total output exceeding $2 trillion. In the last decade, Poland has quietly surpassed Sweden, Belgium, and Argentina—moving from a “catch-up” economy to a top-tier European performer.

What’s remarkable isn’t just the speed, but the breadth. Poland’s economic expansion is driven by:

Manufacturing: Anchored by automotive, energy equipment, and now EV battery production.

Foreign direct investment: From Intel’s new R&D hub in Kraków to global fintechs setting up in Gdańsk.

Domestic demand: Bolstered by demographic inflows, particularly over 2 million Ukrainians integrating into the labor market.

Defense modernization: The country has ordered more tanks and artillery than any other European nation and is building out domestic arms production.

Poland is also investing in digital sovereignty, with cybersecurity hubs in Warsaw and Łódź, and a national AI strategy that’s being quietly studied in Brussels and Tallinn.

A G20 Role Without the Seat

Poland is not (yet) part of the G20. But functionally, it’s acting like it is. Its GDP now exceeds that of Australia and Saudi Arabia, both G20 members. Its growth rate is stronger than Canada, Japan, Italy, and the United Kingdom.

Officials in Washington and Berlin have begun to suggest that if the G20 were created today, Poland would be in the room by default. It has also become an indispensable partner in the rebuilding of Ukraine, hosting strategic logistics hubs, reconstruction summits, and security coordination centers.

In the words of Jan Zieliński, Poland’s former ambassador to NATO, “We are no longer the eastern frontier of the West. We are the front row.”

Can Warsaw Handle the Weight?

Still, power invites scrutiny. Poland’s political landscape remains volatile, polarized between a conservative-nationalist establishment and a liberal, pro-EU opposition. While EU funds have resumed flowing after a judicial reform compromise earlier this year, the road to constitutional harmony is still uncertain.

There is also a question of balance: Poland’s heavy military spending may crowd out social investments unless fiscal discipline is maintained. And while foreign investors are enthusiastic, some worry about overconcentration in a few export sectors. Yet few doubt that Poland is no longer riding the coattails of larger nations. It is, in a real sense, shaping the future of the continent.

Not Just a Regional Power Anymore

Poland’s rise comes at a time when Europe is searching for its next growth story—and its next backbone. The United Kingdom has left. Germany is cautious. France is preoccupied. Italy is burdened. Poland, remarkably, is none of those things. It is confident, growing, assertive, and still underestimated. For now.

But not for long.

Note: This article reflects data current as of June 28, 2025, and incorporates verified forecasts from the International Monetary Fund and OECD. The cover story referenced from The Economist appeared in its May 22, 2025 issue.